An overdraft is not supposed to be a long-term lending solution and should be used as an emergency fund according to banks own literature.

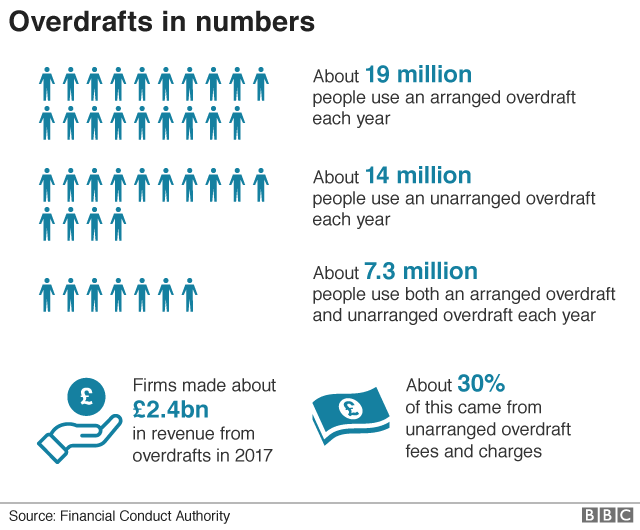

However, millions of people across the UK have been living continuously in their overdraft and paying high interest rates.

The banks have a responsibility to help consumers who are using it as a long-term lending solution to find a cheaper alternative.

You can make an affordability complaint and ask for a refund of overdraft charges if:

your overdraft limit was increased to a level you are unable to clear; or

your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot.

Decide which reasons apply to your overdraft complaint.

Read through these and think about which apply to your case.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help (the regulator’s word is forbearance) for example by stopping adding charges.

How high is too high?

There is no set figure, it depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

The bank should have seen you were in difficulty

Overdrafts are meant to be used when you have a problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft tgerms and conditions. And even if it isn’t the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in financial distress. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were exceeding your arranged overdraft limit regularly for a significant amount.

How to claim.

Unaffordable lending.

The bank should have known they were unaffordable for you because of all the financial problems it could possibly see on your statements and your credit record.

Here is a checklist, work out if any of these apply to you:

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank;

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, defaults etc;

- using payday loans;

- increasing mortgage arrears;

- making payment arrangements with other creditors;

- a reduction in the income going into your account.

Any of these suggests you are reliant on the overdraft to pay everyday bills and you will find it hard or impossible to repay the overdraft and not use it the next month.

We will look for adverse information on your credit report to be rectified due to unaffordable lending.